Introduction

If you’ve been doom-scrolling national headlines, you’d think housing either collapsed over the weekend or doubled in price while you made toast. Neither is true here. The Triangle is doing what the Triangle does: shrugging at the drama, rebalancing slowly, and rewarding anyone who buys and sells with a plan.

Below is the state of play—rates, inventory, prices, time on market, and who’s got leverage—plus clear moves for sellers, buyers, and investors. All numbers are current or as recent as last week, with sources cited so you don’t have to take our word for it.

The Rate Backdrop: A Little Easier to Breathe

The 30-year fixed average ticked down to ~6.27% in mid-October per Freddie Mac’s weekly survey. That’s a hair lower than last week and lower than this time last year (6.44%). Translation: monthly payments eased—slightly—and refi chatter is waking up again. Freddie Mac

National outlets will argue whether rates crash below 6% any time soon. Some economists say “don’t count on it,” forecasting 6–6.5% through 2028 (yes, really). Fine—budget for six-something, then be pleasantly surprised if we dip. New York Post

What that means here: A stable six-ish percent rate plus rising local inventory is exactly the recipe for a calmer, more negotiable Triangle market heading into late fall.

Inventory & New Listings: The Shelf Is Finally Stocked

At a regional level, the Triangle’s for-sale supply has been climbing for months. In the spring, Axios reported inventory up ~30% year over year across Wake, Durham, Orange, Johnston, and Chatham—an arc that’s continued into fall. More choice, fewer bidding circuses. Axios

Zooming in:

- Triangle-wide snapshot (broker aggregation): As of late summer/early fall, The Triangle showed ~9,600 active listings, 3.7 months of supply, and 53 days on market (August read). That’s not “buyer’s market” yet, but it’s a long way from the 2021 madhouse. Market Minute

- Wake County: September updates circulating locally show active inventory up 30–35% versus last year, with more new listings finally hitting. Net: buyers have options, sellers can’t phone in pricing anymore. Fab Real Estate Services+1

Bottom line: Sellers have lost the automatic upper hand. Pricing discipline and early condition prep matter. Buyers can be choosy without being reckless.

Prices: Up a Bit Here, Flat There—Call It “Sticky”

Let’s anchor to actual market pages:

- Raleigh city data: Median sale price about $420,000 in the most recent month on Redfin’s tracker—essentially flat to slightly up year over year. That’s price resilience with less mania. Redfin

- Triangle aggregate (all counties): Brokerage roll-up shows ~$440,000 median recently, with September hovering close to last year (call it ±2%). Again: stickier than the national averages, but hardly runaway. Market Minute

- Statewide context (September): NC REALTORS® notes inventory up, sales a touch down YoY, which jives with our on-the-ground feel: more listings, slightly slower absorption, prices steady to gently cooling depending on sub-market and list-price realism. North Carolina Realtors

Segment nuance: Under $450K in family-friendly suburbs still moves if it shows well; luxury takes longer and negotiates harder. (We’ll come back to the playbook.)

Days on Market & Price Cuts: Time Is a Negotiating Tool Again

Nationally, Realtor.com’s September report shows time on market up across regions and price cuts more common, especially in mid-tier price bands. The South (that’s us) is taking about eight days longer than last year, which tracks with what we’re seeing at showings—more second looks, fewer same-day sprints. Realtor

Locally, 53 days on market (Triangle aggregate in August) puts us squarely in “normal-ish” territory versus the last few years. That’s healthy. Sellers: your house isn’t “stale” at day 21; it’s just existing in reality. Market Minute

Migration & Demand: The Pipeline Is Still Flowing In

Interest in Triangle listings remains heavy from out-of-area buyers—Northern Virginia, Atlanta, New York. Some counties see 80–90% of listing views coming from outside their borders. People still want to move here; they’re just not overpaying by 12% on a whim anymore. Axios

That steady inflow is why this market doesn’t fall off a cliff when rates wobble: demand gets deferred, not destroyed.

City Snapshots

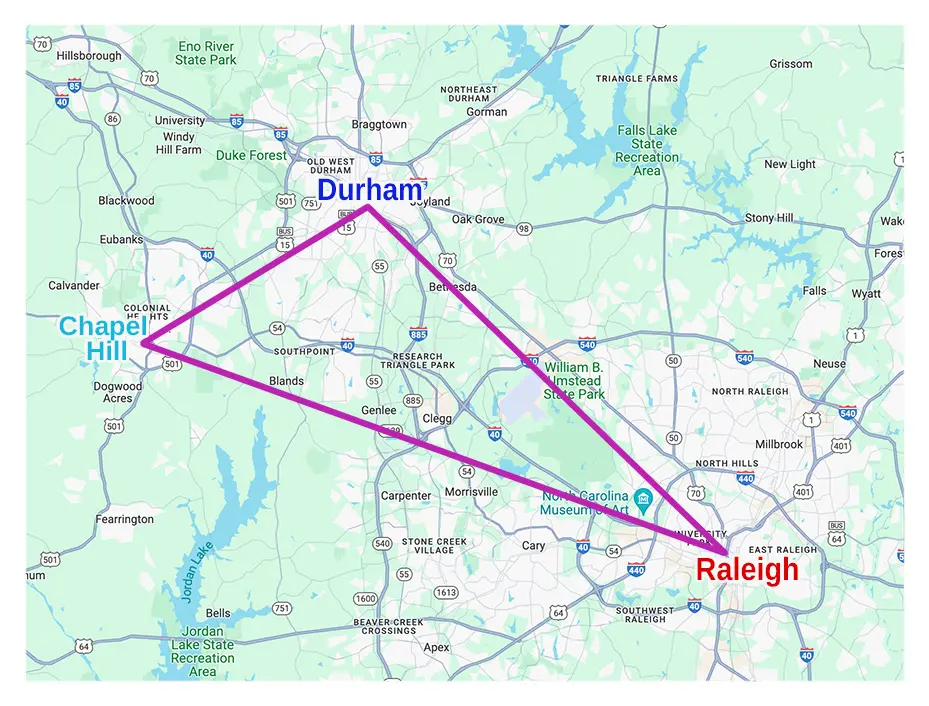

Raleigh

- Median sale price around $420K, homes averaging ~44 days and roughly two offers when priced right. Think realistic list price, clean presentation, and it moves. Redfin

Durham

- Realtor.com metro pages show median listing prices in the mid-$400Ks depending on ZIP (27713 ~ $440K; 27707 ~ $470K). Durham’s urban-suburban blend still pulls relocators, but list-price pride gets punished. Realtor+1

Broader Triangle

- Aggregate lens (August): 2,811 units sold, 3,599 new listings, 9,603 active inventory, 53 DOM, 3.7 months of supply—which screams “balanced drifting toward buyer-friendly” rather than any kind of crash. Market Minute

Who Has Leverage Right Now?

- Entry to mid-price (sub-$450K): Slight seller edge if the home is updated and priced tight to the comps. If you’re dated by a decade, buyers will make you feel it.

- $500K–$900K suburbs: Balanced to buyer-tilt. Buyers have choices; sellers need to nail presentation and strategy.

- $1M+ and custom: Longer DOM, more renegotiation. Premium has to be earned (lot, schools, finishes, energy efficiency).

Overlay 6.2–6.4% rates and you get a market that rewards intelligent pricing and punishes magical thinking. Freddie Mac

Seller Playbook (Fall 2025)

- Price to the last 60–90 days, not 2022 fairy tales. The market pays full for “turn-key under $450K,” not “needs everything but hope.” Triangle-wide data shows balanced conditions; overpricing adds weeks and invites cuts. Market Minute

- Front-load condition: Minor pre-listing repairs + clean inspection = leverage when buyers ask for the moon. Realtor.com’s trendlines favour homes that show well as time on market stretches. Realtor

- Expect second looks: Longer DOM is normal. If you’re priced right and traffic is steady, don’t panic-cut at day 14.

- Concessions are back: Rate buydowns, closing cost help—small nudges can protect price while solving monthly payment pain (remember ~6.27% averages). Freddie Mac

Goal: Sell within the first 30–45 days without death-by-price-cut. If you’re on the market beyond 45 with crickets, it’s price, presentation, or both—fix it fast.

Buyer Playbook

- You can breathe now. More inventory, slightly softer days on market, and price cuts in certain bands mean you can negotiate and keep your dignity. (National data shows time on market up; we’re seeing the same vibe here.) Realtor

- Bid surgically, not cynically. Great homes under $450K can still get multiple offers. Don’t lose a good house over $4K and then spend $12K moving twice. Use comps, not Twitter. Redfin

- Use terms to win without overpaying: Rate buydown requests, quick inspections, and flexible closes work wonders.

- Think 7-year math: If economists are right and we hover in the 6s for a while, buy a home you love at today’s payment—refi if we get a break later. New York Post

Investor Playbook (This is where you eat)

- Yield hunting is back. With 3.7 months of supply and rising inventory, you can structure deals—seller credits, repairs, rate buydowns—to hit target cash-on-cash. Market Minute

- Mid-tier SFR in rental-strong school zones remains the safest long-term bet. Demand inflow supports occupancy; you’re buying cash flow plus appreciation optionality. Axios

- Flip discipline: Cosmetic flips under neighborhood medians can still work—but your buy box must be ruthless. DOM and price-cut trends mean ARV fantasies get smacked. Use real, local comps from the last 90 days, not your feelings. Realtor

- Build relationships now. Rising inventory means more “make-ready” opportunities from tired sellers. Off-market will loosen as winter approaches.

The Big Picture (and Why It’s Not 2008)

- Rates: Floating in the low-to-mid 6s. Not cheap, not catastrophic. Freddie Mac

- Supply: Rising to healthy levels; buyers finally have choice. Axios+1

- Prices: Holding or gently adjusting by sub-market; Raleigh itself sits near $420K median. Redfin

- Pace: Slower, saner, and better for thoughtful decisions (national trend corroborates more days on market). Realtor

- Demand: Still fueled by relocations and remote workers targeting Triangle value; out-of-area interest remains high. Axios

No bubble, no free fall—just a grown-up market that rewards proper pricing and punishes hubris. Think chess, not whack-a-mole.

What I’d Do This Week (If I Were You)

- Sellers: Get a pre-list inspection, complete the $2–5K in easy wins, and price to sell in 30 days, not to “test the market.” Then sweeten with a small rate buydown if needed. Realtor+1

- Buyers: Shortlist three neighborhoods and three floor plans. Tour the best six homes in the next 10 days. When you find “the one,” write for value (not venom) and ask for a concession.

- Investors: Pull a hot-sheet of 30+ DOM under median price in landlord-friendly ZIPs with strong schools. Make five clean, numbers-first offers by Friday. Use months-of-supply and recent DOM to lean into price or credits. Market Minute

Final Word

This is the Goldilocks stretch the Triangle rarely gives you: rates you can live with, inventory you can choose from, and prices that behave like adults. If you want 2021 fireworks, you’ll be waiting a while. If you want a smart move you’ll be happy with in seven years, the path is open—just bring discipline.

If you want us to run your buy-box, prep a listing for a 30-day sale, or source investor-grade inventory that actually pencils, We’re here for you.

Sources & Notes:

Freddie Mac Primary Mortgage Market Survey weekly update, Oct. 16, 2025 (avg 30-yr 6.27%). Freddie Mac

Triangle inventory growth context (Axios Raleigh). Axios

Triangle aggregate (Aug 2025): units sold, months of supply, DOM, active inventory (Long & Foster Market Minute—The Triangle). Market Minute

Raleigh city page—median sale price and competitiveness (Redfin market page). Redfin

National trend—time on market rising and price cuts more common (Realtor.com Sept 2025). Realtor

Out-of-area demand for Triangle listings (Axios Raleigh). Axios

Rate path commentary—MBA economist outlook (context for planning). New York Post